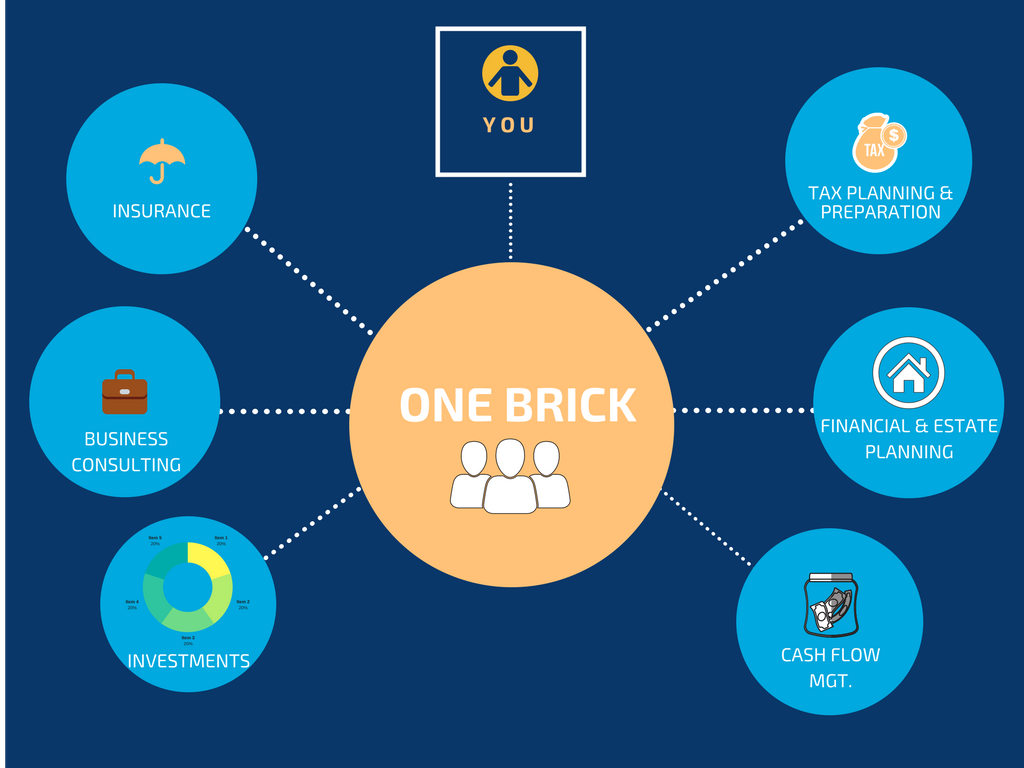

Why One Brick Wealth?

Out of the box thinking regarding finance, tax, and investments.

Integrated advice that looks at your financial situation holistically.

A Long-Term Investing Philosophy Designed for Simplicity, Safety, and Outperformance.

We take an evidence-based approach to portfolio construction. Academic research guides the way.

One Brick is committed to transparency and giving the best advice in the industry.

Planning for your wealth should not be a mere transaction but a life-long process. We treat your financial aspirations as if they were our own. As a result, we are always looking for unique ways to add client value. Outside the box thinking is ingrained in our business DNA.

Since we don’t believe in transactional business or relationships we are accessible. Contact us by phone, email, or in-person.

Aaron is the Founder of One Brick Wealth and draws on his multifaceted experience to help clients solve their financial challenges.

Prior to founding One Brick, Aaron worked at Fidelity Investments and at Harris Associates as part of their equity research staff. Aaron also acquired experience in the Retirement Plan space as an auditor for the DOL.

Aaron is passionate about uncovering each client’s unique set of financial opportunities.

Nick handles the full spectrum of estate and business planning needs.

Klimas Law offers Will and Trust formation, Gun Trusts, Power of Attorney documents and Guardianship Designations. One of the most accommodating Estate Planning practices in Denver because nothing is more important to us than maintaining the close personal connection and service our clients deserve while providing big law quality services. Our goal at Klimas Law is to provide exemplary customer service to our clients while positively and quickly resolving their issues.

Aaron is the Founder of One Brick Wealth and draws on his multifaceted experience to help clients solve their financial challenges.

Prior to founding One Brick, Aaron worked at Fidelity Investments and at Harris Associates as part of their equity research staff. Aaron also acquired experience in the Retirement Plan space as an auditor for the DOL.

Aaron is passionate about uncovering each client’s unique set of financial opportunities.

Got Six Figures in Student Loans? We can help create a plan that will position you for success.